How To Make cc.fees Tax Deductible

By default, the cc.fees item will not be tax deductible. This page will help you change that for your specific event.

WARNING

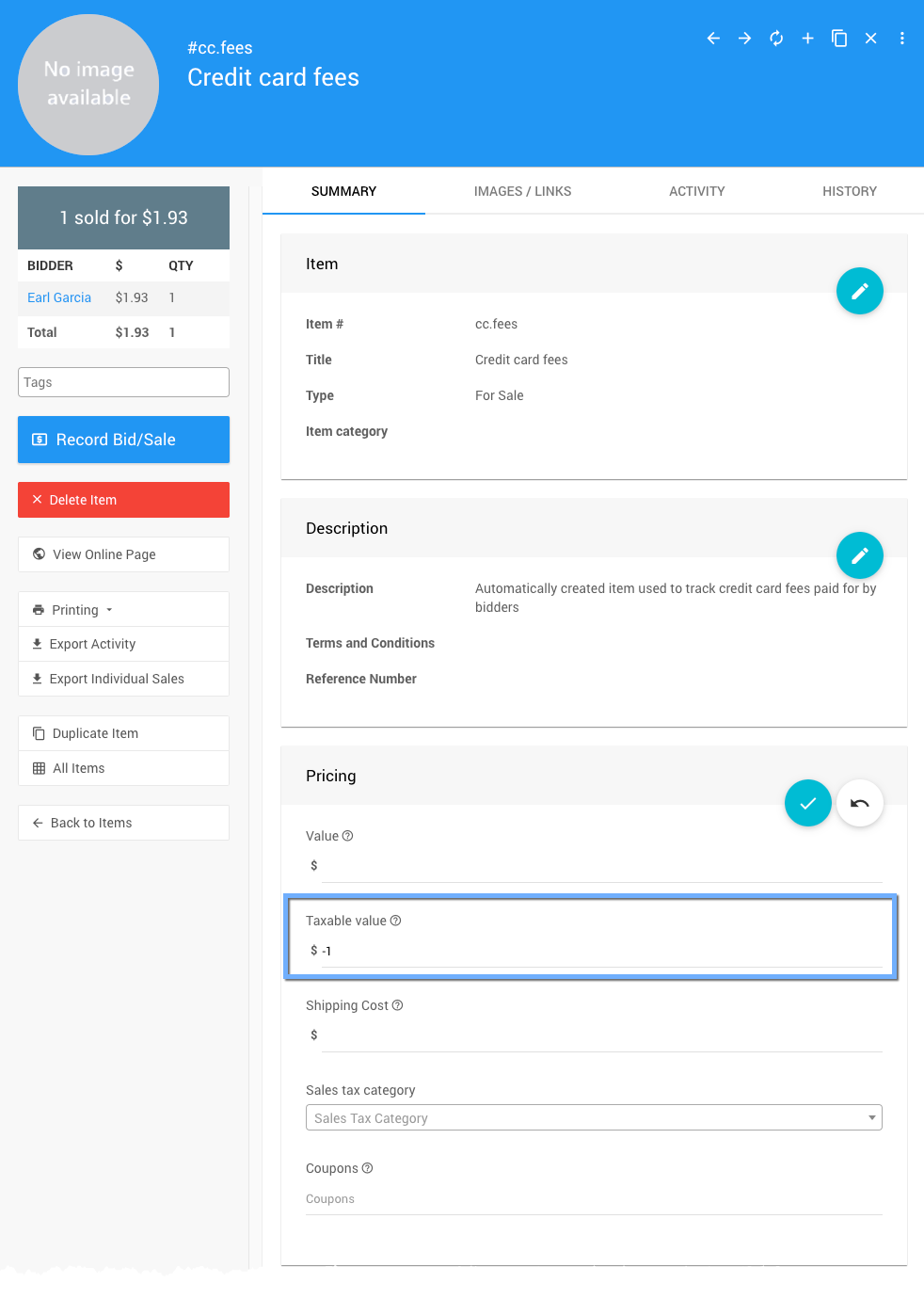

The cc.fees item is system generated. The Item Number and Type must not be altered, including the case sensitivity of the letters used in the item number.

The cc.fees item needs to be created upfront for this and is most easily done by creating a charge in the event, under Test mode, to generate this default system item.

By default, the Credit Card Fees (cc.fees) item is set as a For Sale Items type.

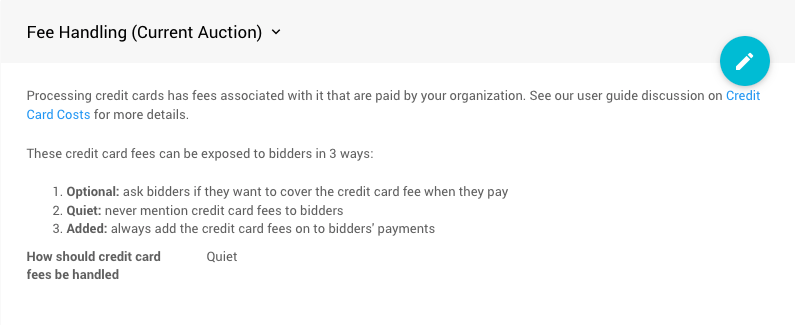

To generate the cc.fees item, you will need to enable an option under Credit Cards for Fee Handling (Current Auction) section using the Optional or Added modes.

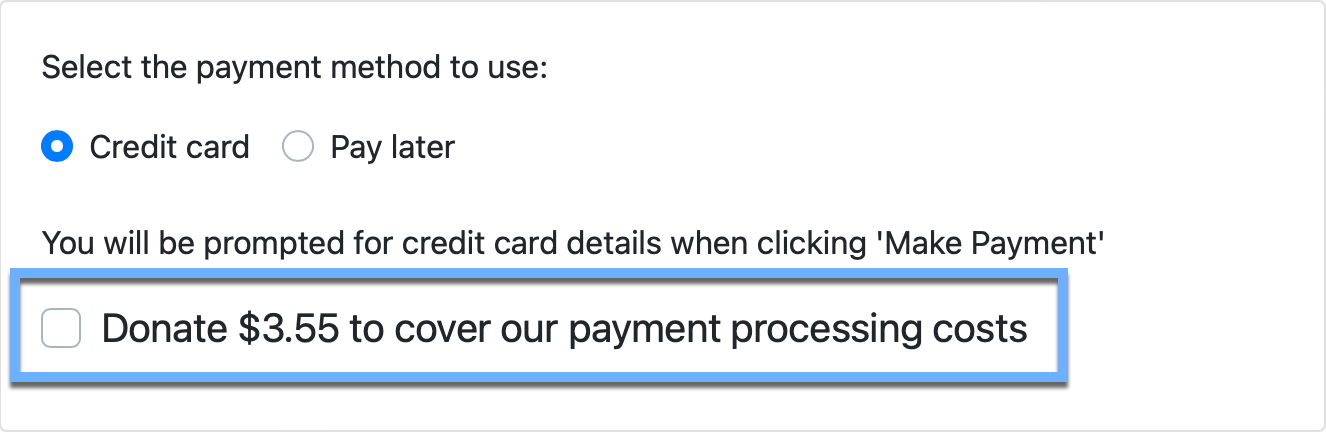

With the Credit Card Settings configured, you will see something similar to the example below of the fees optionally available for the bidder to pay.

Check the box if the Optional mode is used to pay the fees and complete the transaction. The cc.fees item will be created at this point.

You can also create the cc.fees item from the administration pages using a Checkout transaction or a Record Purchases transaction with an appropriate Fee Handling mode set.

REMINDER

Once the cc.fees item has been created in Test Mode, remember to switch back to Live Mode before the beginning of the event.

If you want cc.fees to show as "tax-deductible" on statements, you can open the Item Details page for the cc.fees item and set its Taxable value field to -1. This generally triggers a For Sale item to be fully tax deductible.

Last reviewed: October 2023