Taxable Value

If you are a registered charity, bidders may be eligible to claim a tax deduction for their "donations."

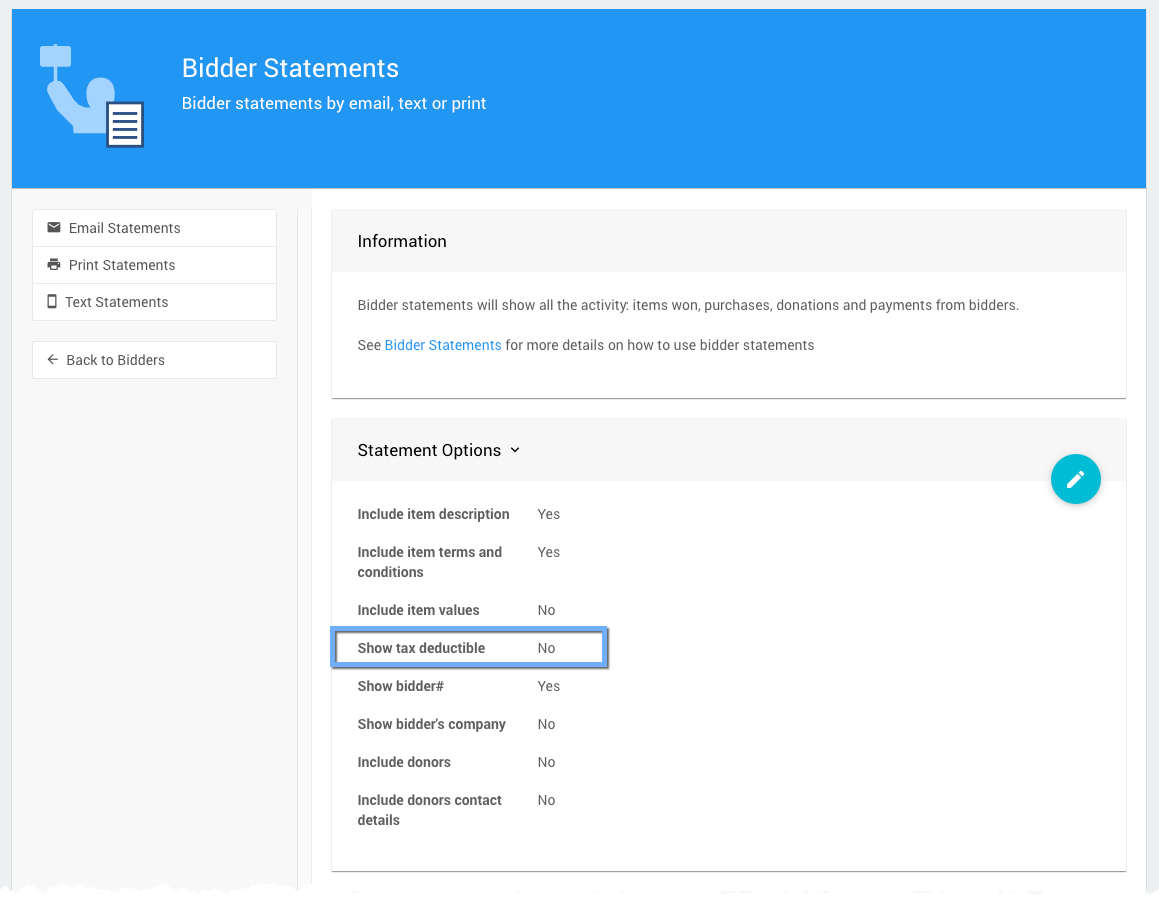

Show Tax Deductible

The Participant Statements can be configured to show a Tax Deductible column for each item.

Tax Deductible Amount

By default, the Tax Deductible amount is the amount by which the bid, or purchase price, for an item exceeds its Value except for Donation Items where the total amount is always treated as fully tax receipt-able.

Taxable Value Amount

You can override the calculation for an item using the Taxable Value field. Any bid or purchase amount in excess of the "Taxable Value" is shown as tax deductible if set. By default, the Taxable Value field is blank (and treated as 0), which means using the item's Value.

If you set the item Taxable Value to -1, which displays as Priceless, it will be treated as fully tax deductible.

For example, if you have a gala ticket that is $200 but only $75 is tax deductible, you would create the item as a For Sale Item with a value of $200 and a "taxable value" of $125. A bidder purchasing this for $200 would see a tax-deductible amount of $75 on their "statement."

Taxable Value is a fixed amount and is not reduced with a coupon code unless the discount makes the guest cost less than the Taxable Value amount.

More Reading

See What Is "Taxable Value" Used For? for more information.

Last reviewed: August 2023