Income Summary

The Income Summary panel at the bottom right of the Dashboard And Event shows a financial summary of your events income and expenses.

All examples taken from a demonstration event.

The rows you see on the income summary will depend on the types of activity in your event.

You can click through on each row to see more details of the transactions that made up that view.

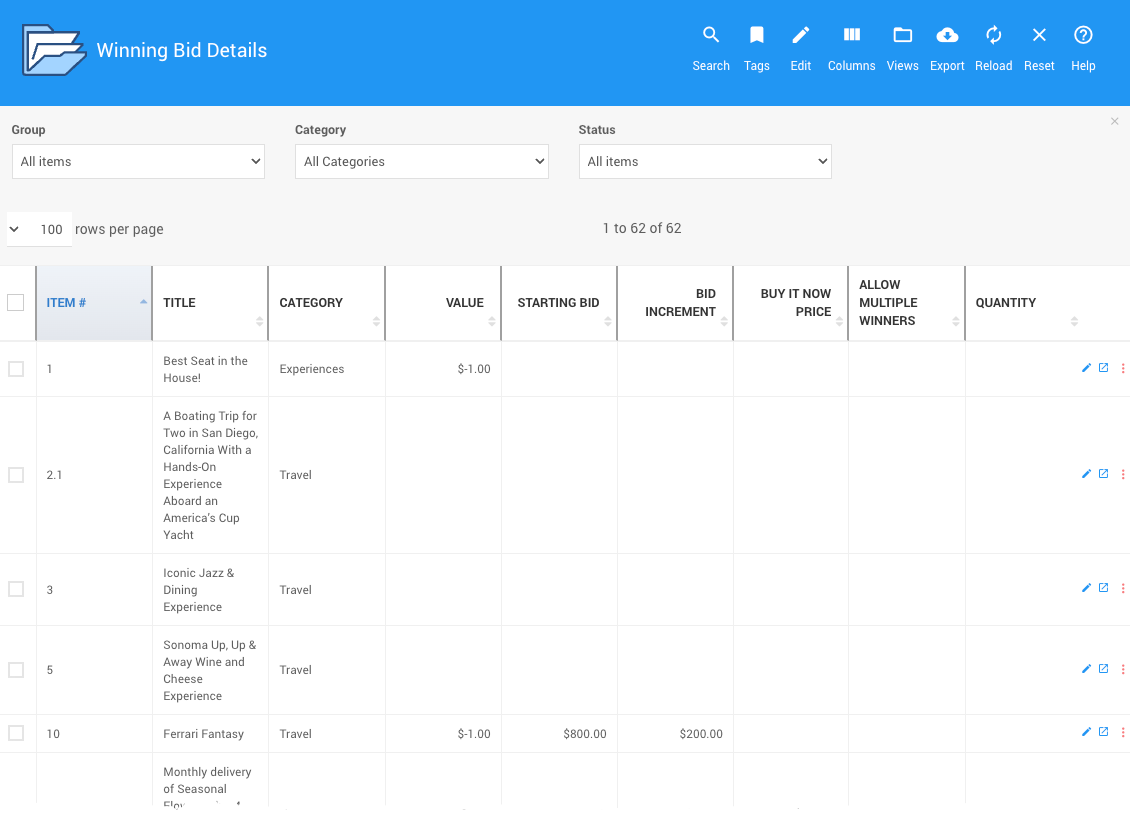

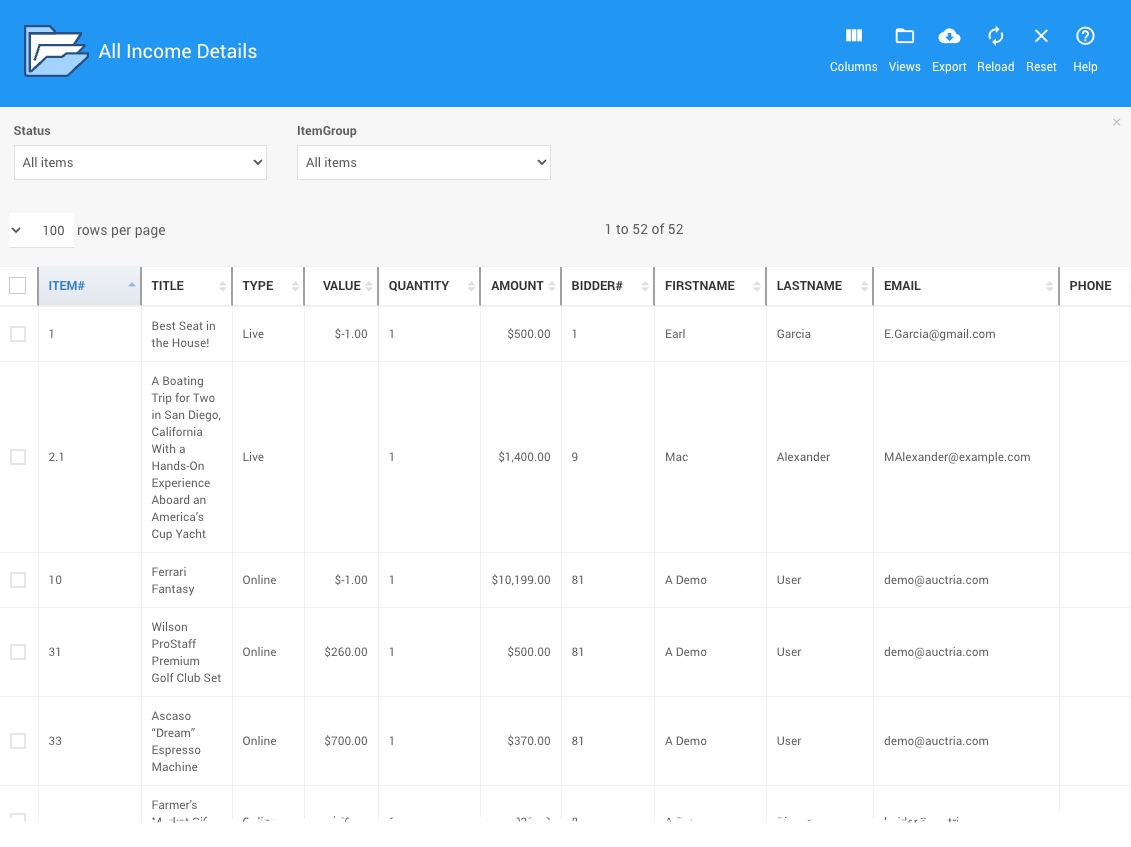

∞ Report ViewsWon Bids

This row shows the total final bids on bidding items. These items are either closed or the bid was placed at the buy-it-now price.

See Reports > Item > Won Items or Winning Bidder Details.

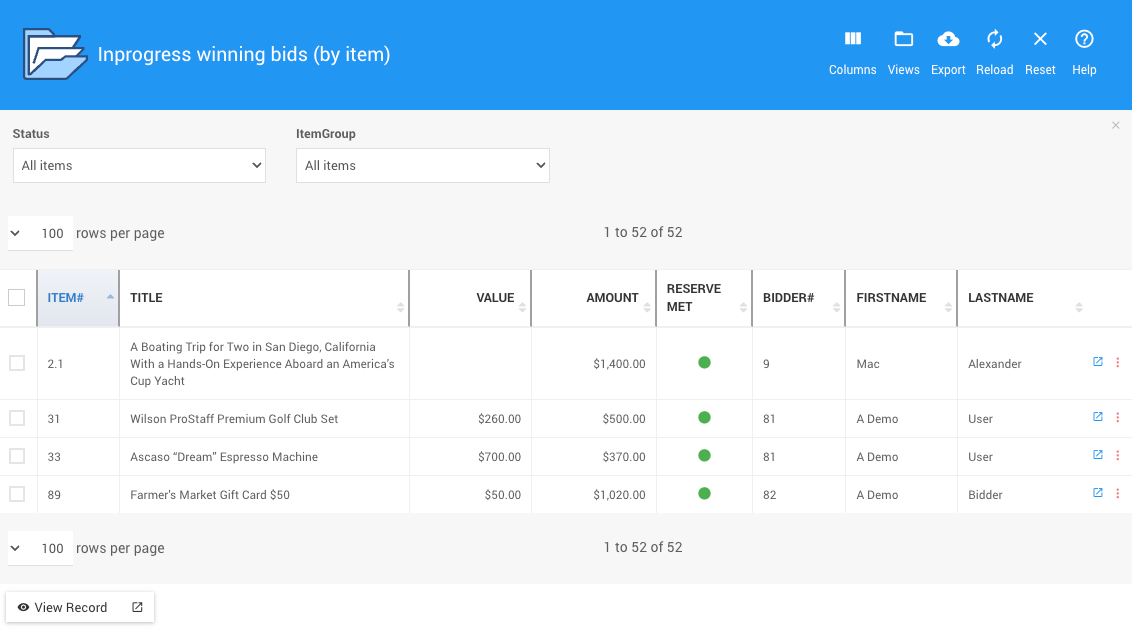

Inprogress Bids

This row represents bids on items that are still open. These are not final bids since they may still be out bid, but this number is the total of the winning bids if those items were to close now.

The In Progress Bids are potential income. The items/values will be moved to the Won Items value as bidding ends on these items. This uses a custom view of the In Progress Items report.

NOTE

The in-progress bids total does not take into account reserve prices or consignment rules.

If a current bid is below a reserve, then when the item actually closes the bid may get canceled, in which case this income would not be realized. Likewise for a consignment item when the item closes an expense record may also be generated which would reduce the effective income from this item.

See Reports > Item > In Progress Items.

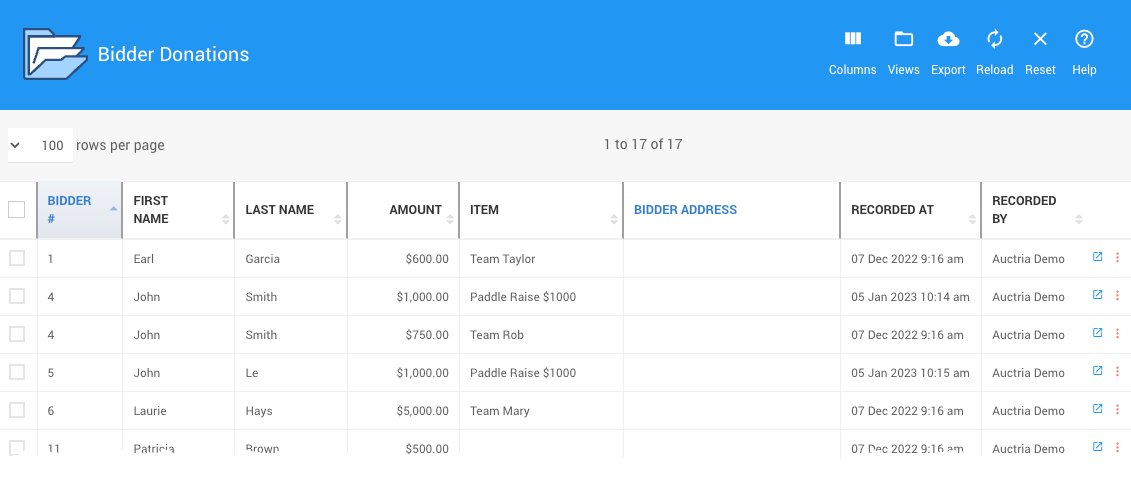

Donations

This row represents donations from bidders, either recorded against Donation Items or as a 'cash' donation recorded with no specific item.

See Reports > Financial > Income | Bidder Donations.

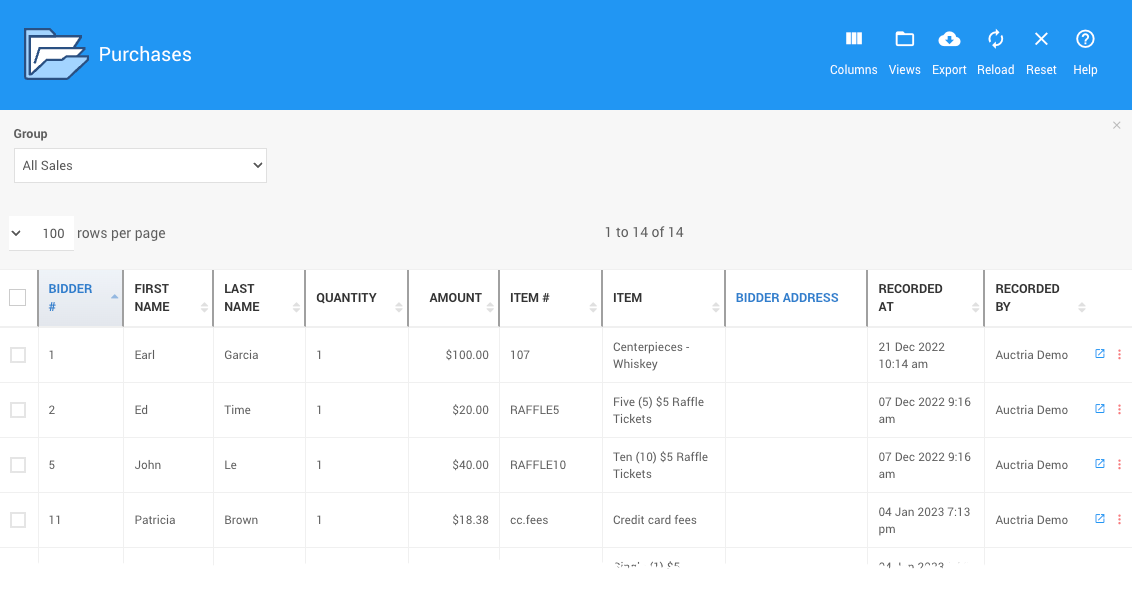

Purchases

This row represents purchases from bidders recorded against For Sale Items, but excluding any credit card fees the bidder has opted to cover.

See Reports > Financial > Income | Bidder Purchases.

Covered Credit Card Fees

This row represents income you received from bidders to cover credit card fees, either because they opted to cover them, or the event was set to automatically add it to bidders' payments.

The bidder does not pay the credit card fee directly, rather they are paying you more to offset the fees incurred.

Gross Income

Gross Income = Donor Donations + Won Items + Inprogress Bids + Donations + Purchases + Covered Credit Card Fees

See Reports > Financial | Income > All Bidder Income for all bidder transactions that contribute to this.

Sales Tax

If your event was set up to charge sales tax the total amount collected will be shown here.

If sales tax was added on to the amounts bidders owed then it is not included in your income and is just listed here for reference. The total amounts owing from bidders would be equal to the bidder income + the sales tax.

If sales tax was already included in the amounts bidders bid, then it is included in the Gross Income line and will be treated as an Expense for calculating net income.

Credit Card Fees

If you are using Stripe for credit card processing then this is the total of both the Auctria credit card fee and the payment processor's fee.

If you are using Authorize.Net then the amount only reflects the Auctria credit card fee. With Authorize.Net we have no way of knowing the actual fee you were charged by the payment processor.

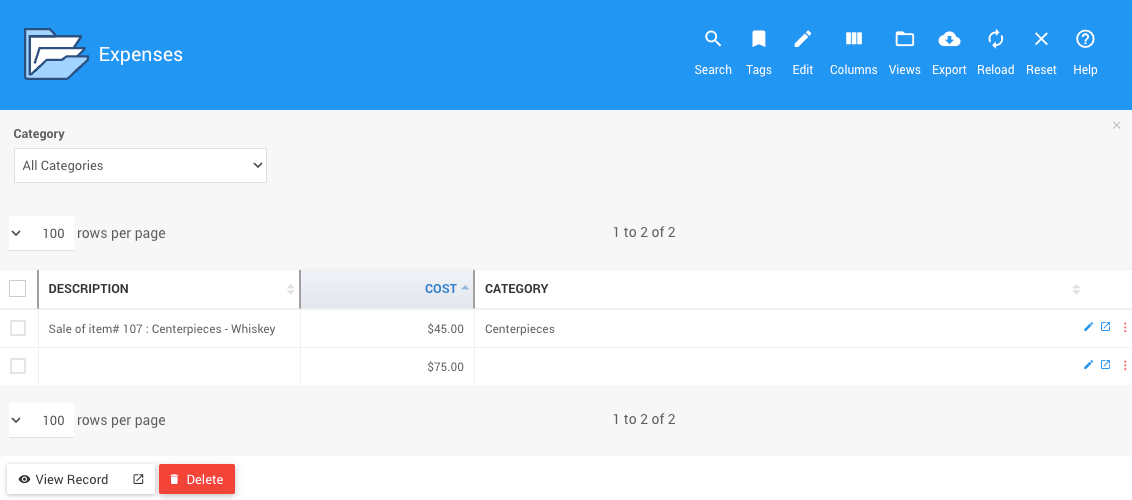

Expenses

This row is the total of additional expenses you have entered into Auctria.

Net Income

Net Income = Gross Income - Credit Card Fees - Expenses

This value calculates the net income given what we know about the event.

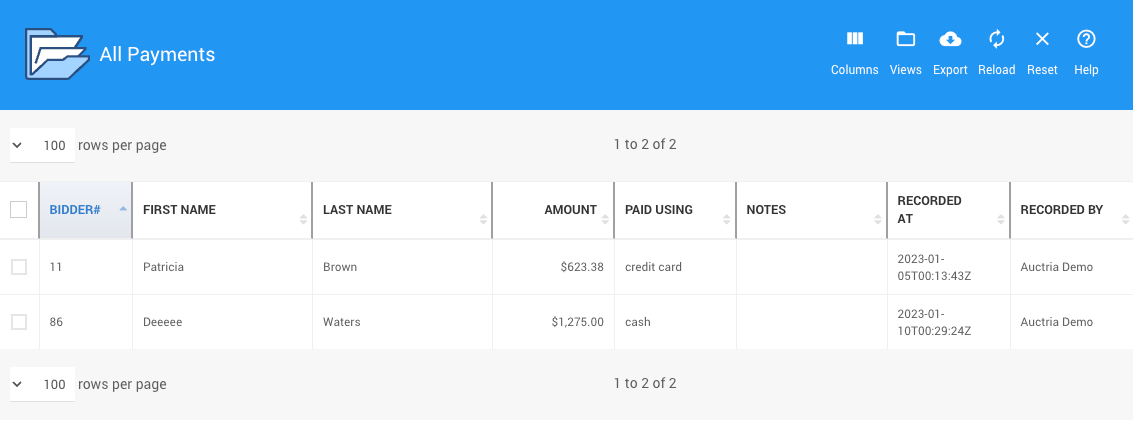

Payments

This is the total of the payments made by bidders.

See Reports > Financial > Payments | All Payments.

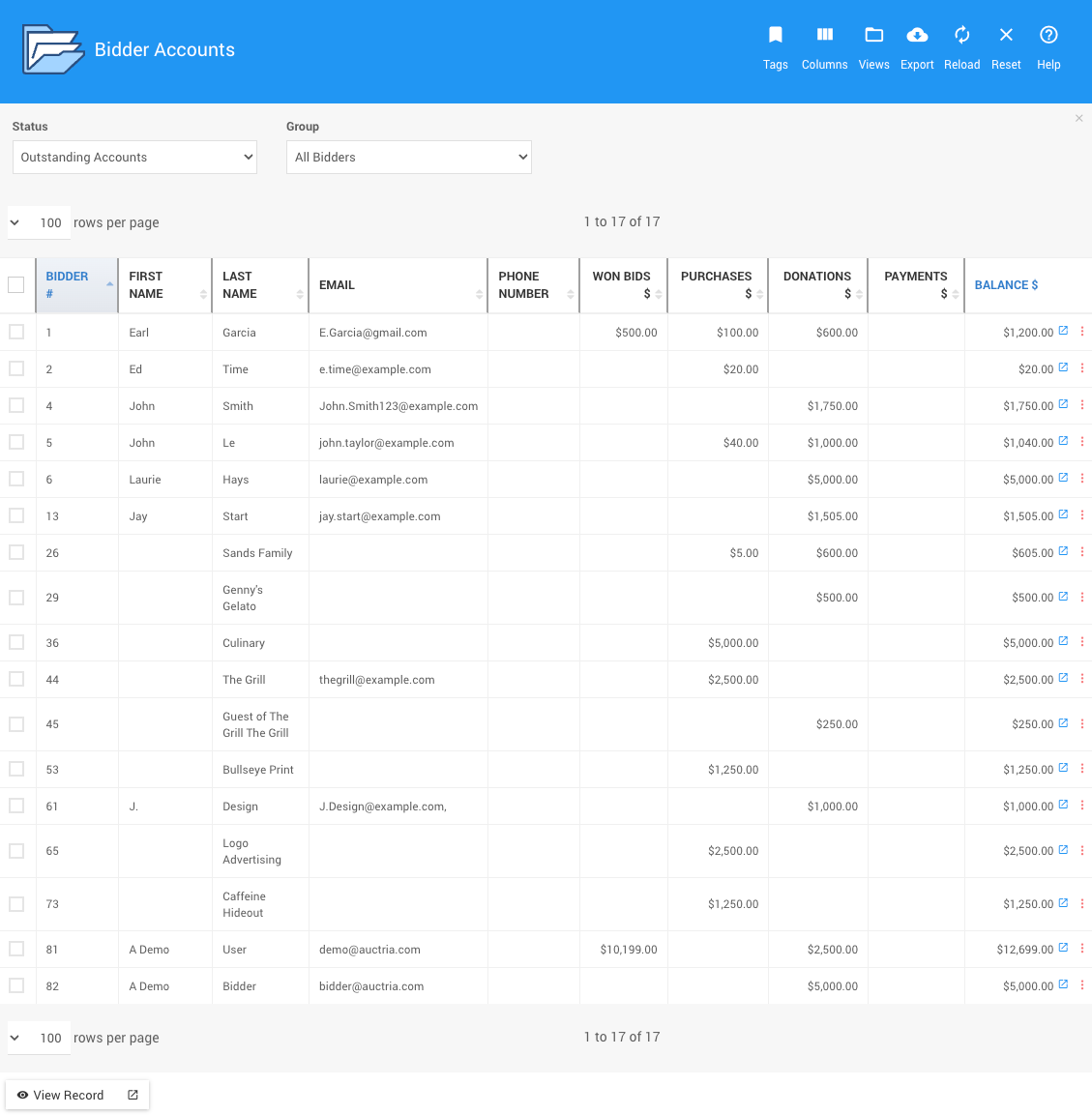

Balance Due

This is the total amount you still need to collect from bidders.

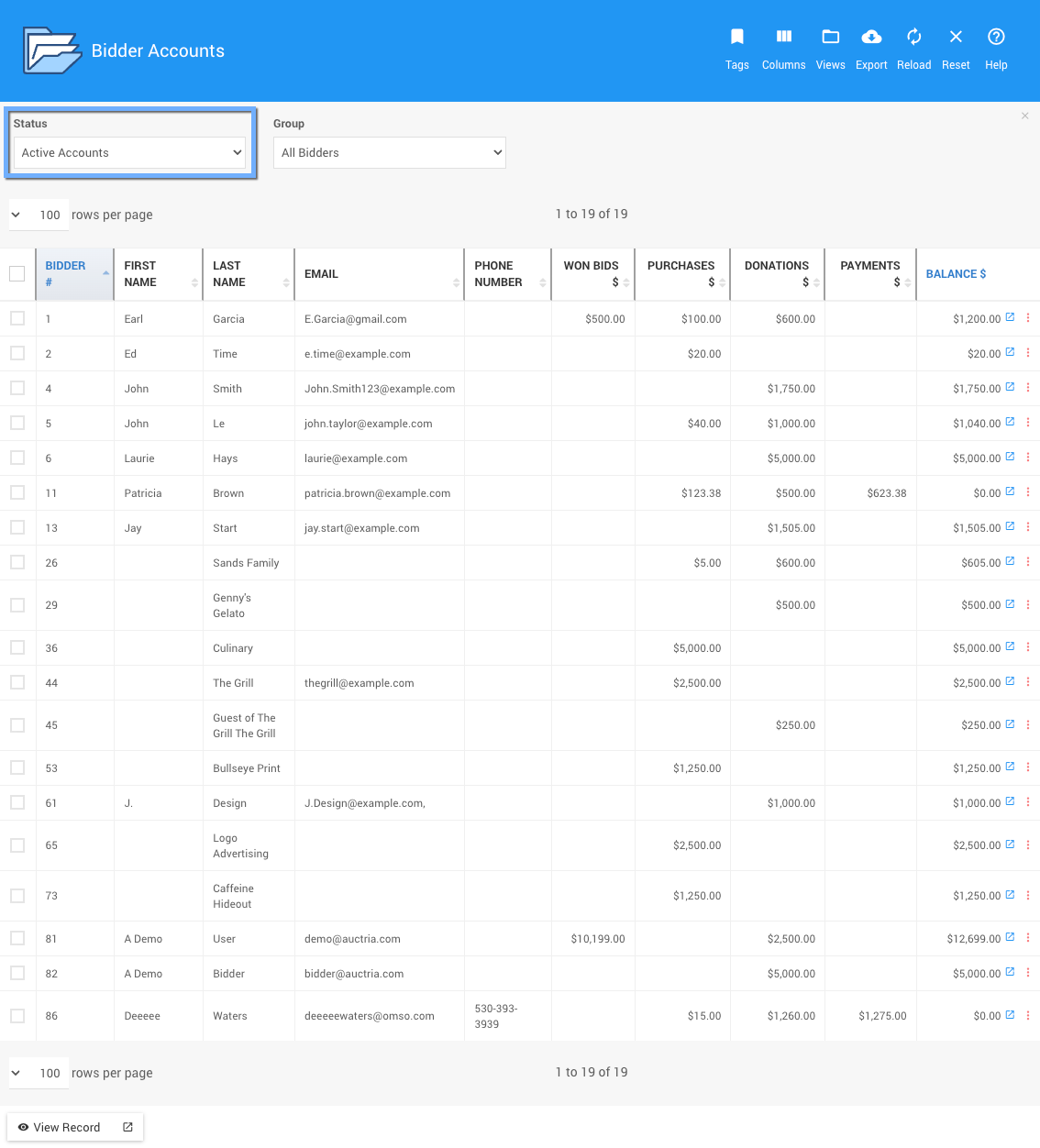

See Reports > Financial > Accounts | Outstanding Accounts.

You can also change the report's Status drop-down selector to use Active Accounts which will then show all transactions/balances.

Credit Accounts

This is the total account balance for all bidders that have paid more than they owe.

Sometimes a payment is recorded in excess of what a bidder actually owes, either accidentally or because some activity is removed but the payment remains in the system.

These types of entries usually indicate some kind of data entry error.

This row is the total of all bidders that have an account balance in excess of what they owed.

The most common fix for these accounts is either to record the missing transaction (e.g. a donation or purchase) or delete or refund the payment.

See Reports > Financial > Accounts | Credit Accounts.

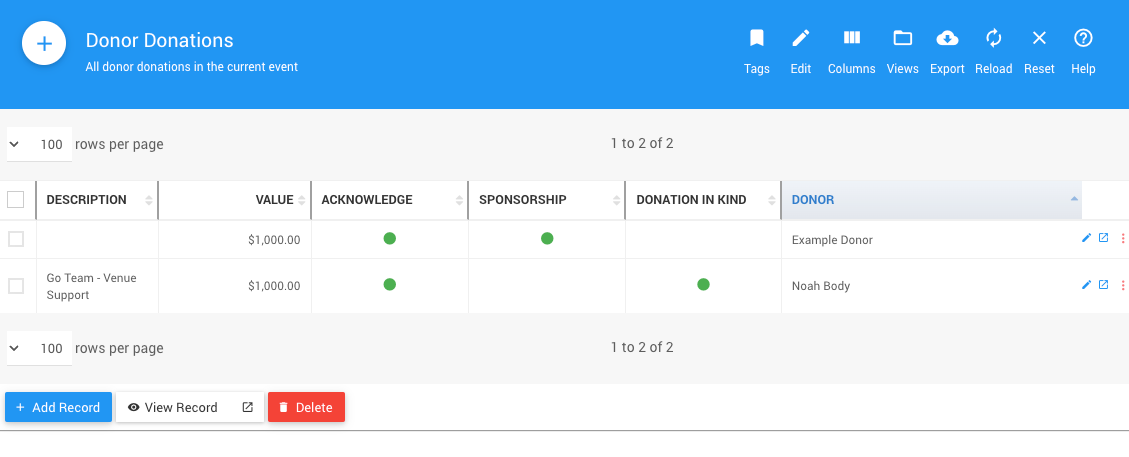

Donor Donation Example Views

Donor Donations

Donor Donations may also be shown in this table.

Any donation entered under Donors All Donations is treated as income, unless the 'donation in-kind' option is set to yes.

However, we do not track the donation and payment separately for donor donations: we just assume it has already been paid for outside of Auctria.

These transactions are included in the Total Income of the event, but would not factor into the Payments amount.

See Reports > Financial | Income > Donor Donations.

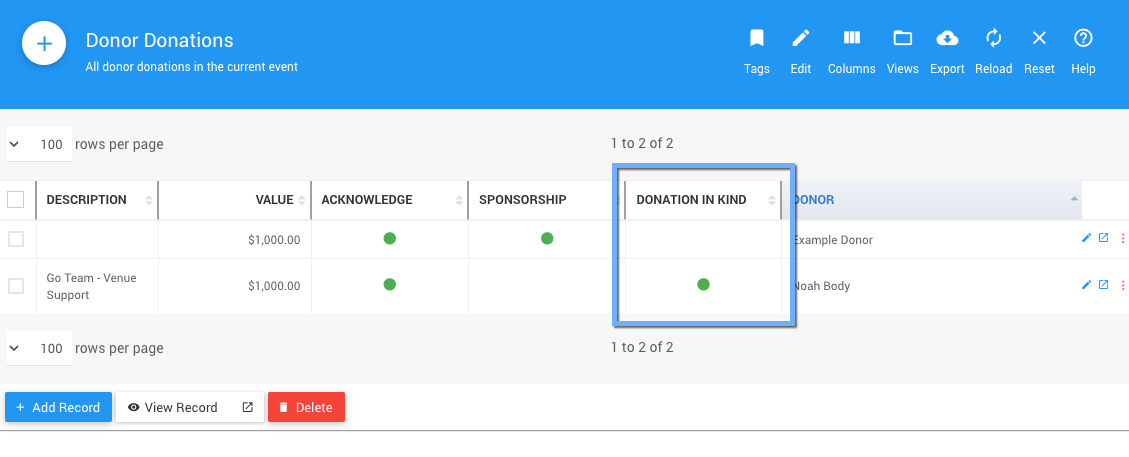

In kind donations

Donor Donations can be marked as 'donation in-kind'. These donations are acknowledged on donor receipts, and allow the donor to be acknowledged on the website but do not factor into the income calculations for Gross Income.

All examples taken from a demonstration event.

From the above screen capture, this would be the "Go Team - Venue Support" as a contribution to provide a space for the event.

Last reviewed: March 2023